wyoming tax rate for corporations

Wyoming does not levy individual or corporate income taxes and its state sales tax rate is low at 4. Wyoming Internet Filing System WYIFS The.

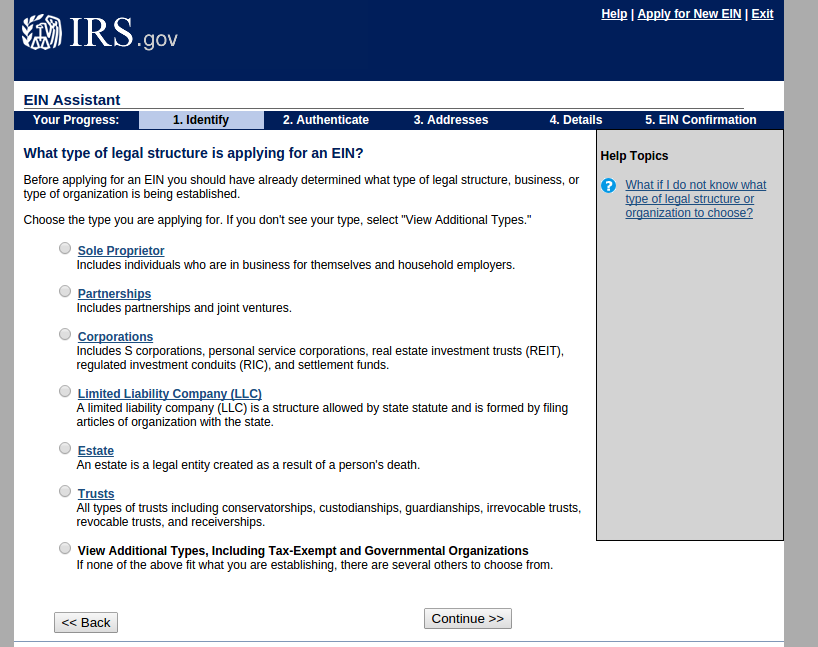

How To Get A Wyoming Based Ein Number For Free With The Irs

Wyoming also does not have a corporate income tax.

. 39-15-105 a viii O which exempts sales of tangible personal property or services. Arkansas saw its rate drop to 62 percent on January 1 2021 as a third phase of tax reforms started in 2019 kicked in. Average Sales Tax With Local.

Wyoming Department of Revenue Website. On average homeowners in Wyoming pay about 1352 per year in property taxes. State corporate income tax rates range from 0 999.

The states average effective property tax rate annual taxes as a. Wyoming is one of seven states that do not collect a personal income tax. In this scenario the Wyoming LLC holding company must have filed an election with the IRS to be treated as a C.

Wyoming Property Tax. Registering for Wyoming Business Taxes Online. The tax is either 60 minimum or 0002 per dollar of.

The corporate tax rate in Wyoming may also differ from the individual tax rate. Have the holding company be taxed like a C corporation. Performed for the repair assembly alteration or improvement of railroad rolling.

Wyoming has a 400 percent state sales tax a max local sales tax rate of 200. Business State Tax Obligations 6 Types Of State. An S-Corp is a pass-through entity and so the earnings are not taxed twice.

The current corporate tax rate federal is 21 thanks to the Tax Cuts and Jobs Act of 2017. The annual report fee is based on assets located in Wyoming. 181 rows 2022 List of Wyoming Local Sales Tax Rates.

Herschler Building 2nd Floor West. Lowest sales tax 4 Highest sales tax 6 Wyoming Sales Tax. Local sales taxes meanwhile are capped at 2.

Wyoming Department of Revenue. This rate is scheduled to decrease even further to 59. A Wyoming LLC also has to file an annual report with the secretary of state.

And the average combined. The one important exception to the general absence of major business taxes in Wyoming is the states annual license tax also known as the franchise tax or fee. Wyomings license fee amounts to 0002 for every dollar of in-state.

That means the company does not pay taxes at the company level only the owners shareholders or members. A Wyoming LLC also has to file an annual report with the. The license tax is a tax on a.

Cheyenne WY 82002-0110. This fee is levied against the in-state assets of limited partnerships LLCs and corporations doing business in the state. Wyoming Department of Revenue.

Wyoming has no state income tax. If you use Northwest Registered Agent as your. Because your Wyoming corporation income flows through to your personal tax return you must pay self-employment tax also known as FICA Social Security or Medicare tax on your.

Only the Federal Income Tax applies. Wyoming does not have an individual income tax. The tax credits would also reduce the effective corporate tax rate of those paying any of the taxes listed above.

Prior to the Tax Cuts and Jobs Act there were taxable income brackets.

Wyoming Tax Benefits Jackson Hole Real Estate Legacy Group Jackson Hole

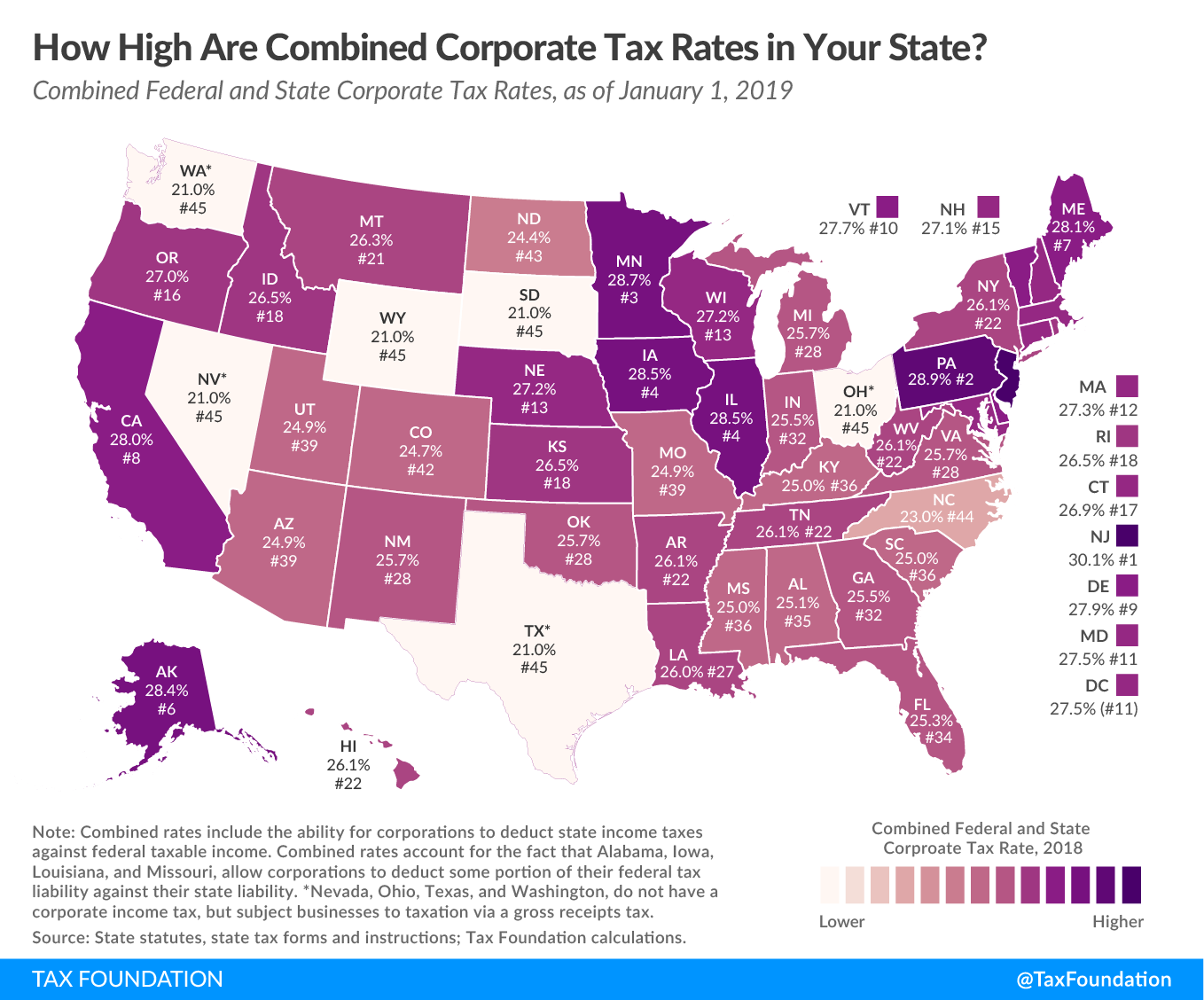

State Corporate Income Taxes Increase Tax Burden On Corporate Profits

Wyoming Electric Customers Will See 2 3 Million Benefit Of Lower Corporate Tax Rate Black Hills Energy

Using A Wyoming Llc As A Holding Company

Wyoming 2022 Sales Tax Calculator Rate Lookup Tool Avalara

Benefits Of A Wyoming Llc Cost Effective Asset Protection

Wyoming Vs Delaware Llc For International Founders Which Is Better For You Doola Blog Doola Blog

How Do State And Local Corporate Income Taxes Work Tax Policy Center

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

Llc Tax Calculator Definitive Small Business Tax Estimator

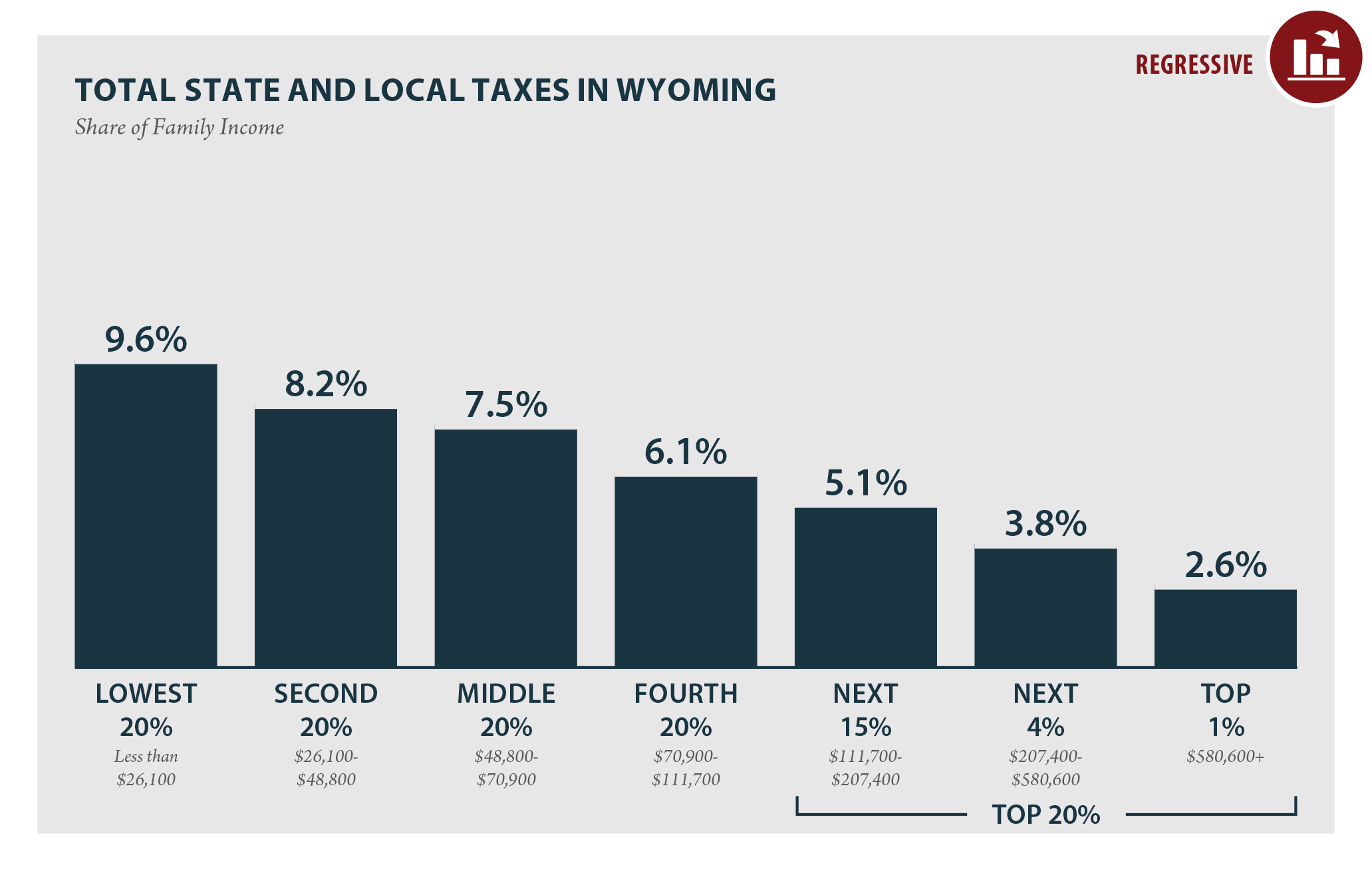

Wyoming Who Pays 6th Edition Itep

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

Wyoming 5 Other Western States Have Best Business Taxes Don T Mess With Taxes

Wyo Named Most Tax Friendly State N Y Worst

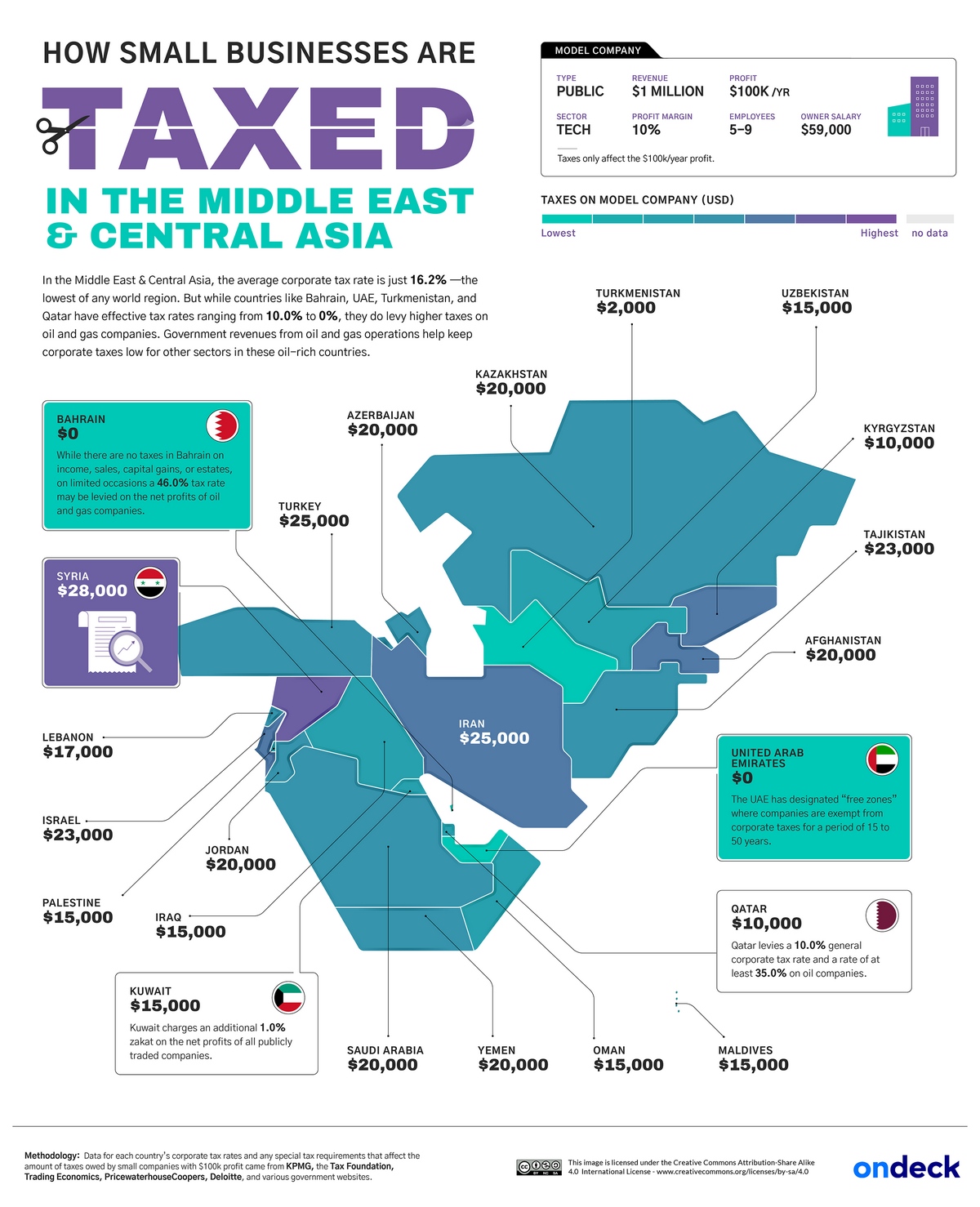

How Do Corporate Taxes For Small Businesses Vary Around The World Vivid Maps

Impacts Of The 2017 Tax Act On Business Valuation Valuation Research

The Numbers Are In Trump S Tax Cuts Paid Off The Heritage Foundation

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-0407c7e1645442deb4af9469534bd165.png)